Difference Between NPV And IRR

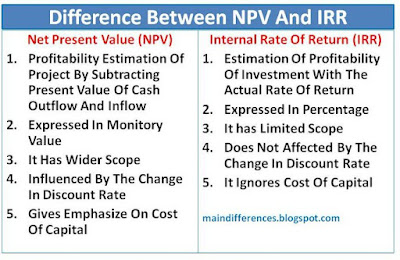

The main dissimilarities or difference between net present value (NPV) And internal rate of return (IRR) can be pointed out as follows:

1. Meaning

NPV: Estimation of profitability of project or investment by subtracting present value of cash outflow from the present value of cash inflow.

IRR: Estimation of profitability of project or investment with the actual rate of return

2. Full Form

NPV: Net present value

IRR: Internal rate of return

3. Expressed In

NPV: It is expressed in a dollar (monetary value)

IRR: It is expressed in percentage (%)

4. Objective

NPV: It is calculated to know the project surpluses

IRR: It is calculated to know the break even point of cash flows

5. Scope

NPV: It has wider scope because it is easy to calculate and simple to understand

IRR: It has limited scope because it is difficult to calculate and understand

6. Commonly Used

NPV: It is the most commonly used technique of project evaluation

IRR: It is not a commonly used technique

7. Cost Of Capital

NPV: It gives emphasize on cost of capital

IRR: It ignores cost of capital or market rate of interest

8. Decision Rules

NPV: A project with positive NPV is acceptable and vice versa.

IRR: A project with higher IRR than opportunity cost is acceptable and vice versa

9. Impact Of Discount Rate

NPV: Change in discount rate changes the NPV also

IRR: Change in discount does not influence IRR

10. Change In Cash flow

NPV: Project can be evaluated in case of changes in cash flows

IRR: Project cannot be evaluated in case of change in cash flows

NPV Vs IRR (Comparison Chart)

I hope this post is helpful to understand the difference between NPV And IRR and to make comparison between them.

NPV Vs IRR (Comparison Chart)

Basis For Difference

|

NPV

|

IRR

|

Introduction

|

Estimating profitability by deducting cash outflows with cash inflows

|

Estimating profitability as per the rate of return

|

Full Form

|

Net present value

|

Internal rate of return

|

Expressed In

|

Monetary value

|

Percentage

|

Purpose/Objective

|

Knowing the surplus of the project

|

Knowing the break even point of cash flows

|

Scope

|

Wider

|

Limited

|

Commonly Used ?

|

Yes

|

No

|

Cost Of Capital

|

Gives emphasis

|

Ignores

|

Impact Of Discount Rate

|

Yes

|

No

|

Change In Cash Flows

|

Project can be evaluated

|

Project cannot be evaluated

|

I hope this post is helpful to understand the difference between NPV And IRR and to make comparison between them.