Difference Between Money Market And Capital Market

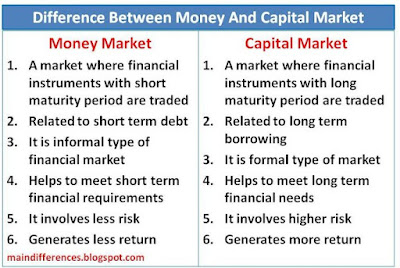

The major dissimilarities or difference between money market and capital market can be pointed out as follows:

1. Introduction

Money Market: A market where financial instruments with short maturity period such as bills of exchange, commercial papers etc. are traded.

Capital Market: A market where financial instruments with long maturity period such as shares, bonds, debentures etc. are traded.

2. Maturity Period

Money Market: Short maturity period (Maximum 1 year)

Capital Market: Long maturity period ( More than 1 year)

3. Related To

Money Market: It is related to short term debt

Capital Market: It is related to long-term borrowing

4. Type Of Market

Money Market: It is informal type of financial market

Capital Market: It is formal type of financial market

5. Objectives

Money Market: It helps the business firms to meet short term financial requirements such as working capital, operating expenses etc.

Capital Market: It helps the firms to meet long term financial requirements such as investment on assets and other properties.

6. Risk Involved

Money Market: Because of more liquidity and short time horizon, it is less riskier than capital market.

Capital Market: Because of less liquidity and long maturity period, it involves more risk than money market.

7. Return

Money Market: It has less return on investment because of less risk and short maturity period.

Capital Market: It generates more return because of long maturity period and high level of risk.

8. Instruments Traded

Money Market: Commercial papers, promissory notes, trade credit etc. are traded in money market.

Capital Market: Bonds, equity shares, preference shares, debentures etc. are traded in capital market.

Also Read:

Also Read:

9. Convertible Into Cash

Money Market: Easily convertible into cash because of high liquidity

Capital Market: Difficult to convert into cash because of less liquidity.

10. Nature

Money Market: Credit instruments are homogeneous in nature

Capital Market: Instruments are heterogeneous in nature.

Money Market Vs Capital Market (Comparison Chart)

I hope this post is helpful to understand the difference between money market and capital market and to make comparison between them.

Money Market Vs Capital Market (Comparison Chart)

Basis

|

Money Market

|

Capital Market

|

Introduction

|

Market that concerns with the trading of short term financial instruments

|

Market which is concerned with the trading of long-term financial instruments

|

Maturity Period

|

Short

|

Long

|

Related To

|

Short term debt

|

Long term borrowings

|

Market Type

|

Informal

|

Formal

|

Objective/Purpose

|

Fulfill short-term financial need

|

Fulfill long term financial requirements

|

Risk

|

Less

|

High

|

Return

|

Less

|

More

|

Instruments

|

Commercial paper, trade credit, promissory notes etc

|

Bonds, equity shares, preference shares etc.

|

Nature Of Instrument

|

Homogeneous

|

Heterogeneous

|

Convertible Into Cash

|

Easy

|

Difficult

|

I hope this post is helpful to understand the difference between money market and capital market and to make comparison between them.