Current ratio (also known as working capital ratio) and quick ratio (also known as acid test ratio) are the types of liquidity ratio used to evaluate the firm's ability to meet short term obligations. Current ratio is determined by dividing total current assets with current liabilities. On the other hand, quick ratio is calculated by dividing quick assets(highly liquid assets) with current liabilities.

Difference Between Current Ratio And Quick Ratio

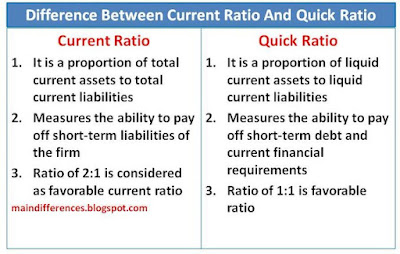

The major dissimilarities between current ratio and quick ratio (also known as acid-test ratio) can be highlighted as follows:

1. Introduction

Current Ratio: It is a proportion of total current assets (total of cash, inventory, securities, prepaid expenses etc.)to total current liabilities (total of bank overdraft, accrued expenses, short term debt etc.) that measures the company's capacity to meet short term liabilities.

Quick Ratio: It is a proportion of company's liquid current assets (cash and cash equivalents) to current liabilities that measures the firm's capacity to meet its financial requirements.

2. Measures

Current Ratio: It measures the ability of the firm to pay off short term liabilities.

Quick Ratio: It measures the ability of the firm to pay off short term debt and current financial requirement by using liquid assets.

3. Formula For Calculation

Current Ratio: It is calculated by using the following formula:

Current Ratio = Current Assets/Current Liabilities

Where,

Current Assets = cash, cash equivalents, inventory, account receivables, prepaid expenses, marketable securities etc.

Current Liabilities = Overdraft, accrued expenses, short term debt, creditors etc.

Quick Ratio: It is calculated by using the following formula:

Quick Ratio = Quick Assets/ Current Liabilities

Where,

Quick assets = current assets - inventory

4. Favorable Ratio

Current Ratio: Ratio of 2:1 is considered as ideal ratio for current ratio

Quick Ratio: Ratio of 1:1 is considered as ideal ratio for quick ratio

Current Ratio Vs. Quick Ratio (Comparison Chart)

Basis

|

Current Ratio

|

Quick Ratio

|

Introduction

|

Proportion of total current assets to current liabilities

|

Proportion of quick assets to total current liabilities

|

Measures

|

Ability to pay off short term liabilities

|

Ability to meet current financial requirements

|

Formula

|

C. A/ C. L

|

Quick Assets/ C. L

|

Favorable Ratio

|

2:1

|

1:1

|

Distinction between current ratio and quick ratio in short

- Current ratio determines the proportion of firm's total current assets and total current liabilities. On the contrary, quick ratio determines the proportion of quick assets (current assets - inventory) and current assets.

- Current ratio is useful to measure the ability to pay current or short term liabilities of the firm. Quick ratio is useful to measure the ability to pay off very short term debts and urgent financial requirements.

- Inventory is included while determining current ratio. But quick ratio is determined by excluding the value of inventory.