Errors of omission refer to those types of accounting errors where transactions omitted (not recorded in journal and ledger accounts) either partially or completely. These errors can be easily rectified by correcting the entry. On the other hand, errors of commission are those errors where transactions are recorded incorrectly in the books of accounts. These errors can be corrected by making rectification entries (debiting or crediting wrong entry and correcting the account).

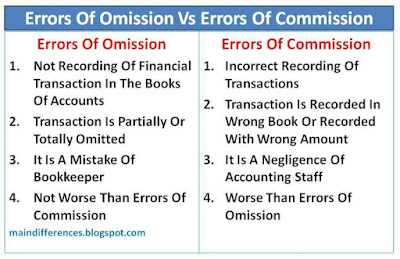

Difference Between Errors Of Omission And Errors Of Commission

The main dissimilarities between errors of omission and errors of commission can be highlighted as follows:

1. Introduction

Errors Of Omission: A kind of accounting error in which financial transaction is not recorded in the books of accounts either partially or whole.

Errors Of Commission: A kind of accounting error in which financial transaction is misrecorded (incorrect record) in the books of accounts.

2. Types

Errors Of Omission: Either transaction is partially omitted(not recorded) or completely omitted.

Errors Of Commission: Transaction recorded in the wrong book, recording of wrong amount, wrong totaling of accounts, balancing errors and carrying forward errors.

3. Reasons Of Error

Errors Of Omission: This type of error is committed due to the mistake of bookkeeper or accountant.

Errors Of Commission: This error is committed because of the lack of accounting knowledge or negligence of accounting staff.

4. Effects On Trial Balance

Errors Of Omission: If the transaction is completely missed , then trial balance will not be affected, but in case of partial recording of transaction, trial balance will be affected.

Errors Of Commission: Trial balance may or may not be affected due to this error.

5. Worse

Errors Of Omission: It is not worse than the errors of commission because it is just an unintentional mistake of accounting personnel.

Errors Of Commission: It is significantly worse because it shows carelessness, negligence and incompetency of accounting staff.

Errors Of Omission Vs Errors Of Commission (Comparison Chart)

Basis

|

Errors Of Omission

|

Errors Of Commission

|

Introduction

|

Not recording financial transactions in the books of accounts either partially or whole

|

Incorrect recording of financial transactions in the books of accounts

|

Types

|

Transaction is partially or fully omitted

|

Transaction recorded in the wrong book, wrong amount is recorded, wrong totaling etc.

|

Reasons

|

Mistake Of Bookkeeper

|

carelessness and incompetency of staff

|

Effect On Trial Balance

|

Trial balance will be affected in case of partial recording

|

Trial balance may or may not be affected

|

Worse

|

Less

|

More

|

Distinction Between Errors Of Omission And Errors Of Commission In Short

- Errors of omission are the accounting errors which are either partially or completely skipped from recording in the books of accounts. Errors or commission are those errors where bookkeeper makes wrong entry (recorded incorrectly) in the books of accounts.

- Error of omission is an unintentional mistake. But error of commission occurs due to the incompetency of the accounting personnel.

- Errors of commission are worse than the errors of omission.